Faye Review: The App That Might Make You Actually Want Travel Insurance

In partnership with Faye. Coverage varies by state. Pricing may vary.

Table of Contents

About Faye

Travel insurance often feels like an afterthought—a checkbox to mark after booking flights and hotels. Many travelers find traditional insurance confusing with dense fine print, paper claims forms, and slow reimbursements when problems occur.

Faye launched in 2022 as a newer player in the travel insurance market. The company focuses on creating a more straightforward experience through their mobile app. Their policies are underwritten by United States Fire Insurance Company, which has an A-rating from A.M. Best and a long history in the industry.

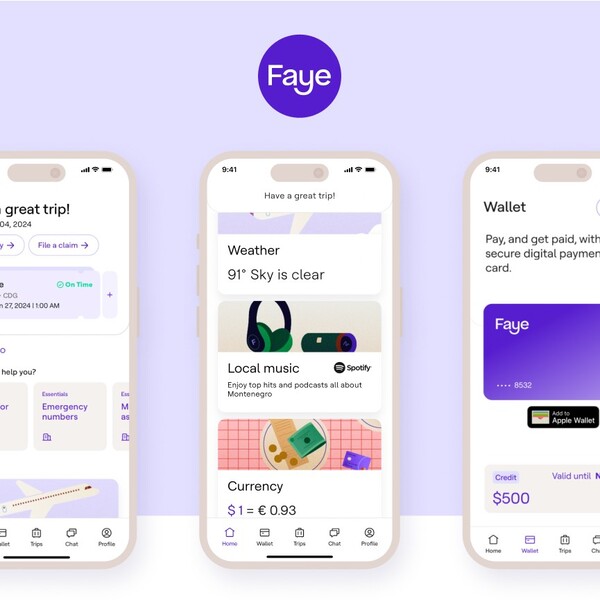

The Faye app allows travelers to purchase policies, submit claims, and receive reimbursements to their phone’s wallet. Their coverage includes medical emergencies, trip cancellations, baggage protection, and several optional add-ons. The company also provides 24/7 support and real-time travel alerts.

While Faye’s digital approach sounds appealing, we wanted to know if it actually improves the travel insurance experience. Many insurance companies make similar promises about convenience and support. This review examines Faye’s coverage options, pricing, claim process, and customer feedback to provide a clear picture of their service.

Join us as we examine what Faye offers travelers and how it compares to traditional insurance options, helping you decide if their protection makes sense for your next trip.

Highlights

- Faye offers digital-first travel insurance that can be managed entirely through their mobile app.

- Their policies can cover medical emergencies up to $250,000 for international trips and $50,000 for domestic trips.

- Customers can receive reimbursements directly to the Faye Wallet, which connects to Apple Pay and Google Pay (even while they’re still in-trip).

- The app provides real-time flight alerts and travel information including weather updates, destination vaccine requirements, and local emergency numbers.

- Claims are typically processed within a few business days once all necessary documentation is submitted.

- Their Safekeeping feature securely stores digital copies of important travel documents like passports.

- Faye’s coverage includes COVID-19 as a standard illness for both trip cancellation and medical expenses.

- Customer support is available 24/7 through in-app chat, email, Whatsapp and phone.

- Users can purchase optional add-ons for pet care, rental cars, extreme sports, and vacation rental damage.*

- Trip inconvenience coverage can provide $200 per incident (up to $600) for issues like flight delays and hotel late arrivals.

Why You Should Trust Us

Our mission is to help you make better, more informed purchase decisions.

Our team spends hours researching, consulting with medical experts, gathering insight from expert professionals, reviewing customer feedback, and analyzing products to provide you with the information you need.

Faye Review

Faye travel insurance brings a mobile app focus to an industry known for paperwork and phone calls. Our review looks at how Faye actually performs based on real coverage details, customer experiences, and pricing. We’ll examine their specific features, benefits, and costs to give you a clear picture of what to expect if you choose Faye for your next trip.

Unique Features

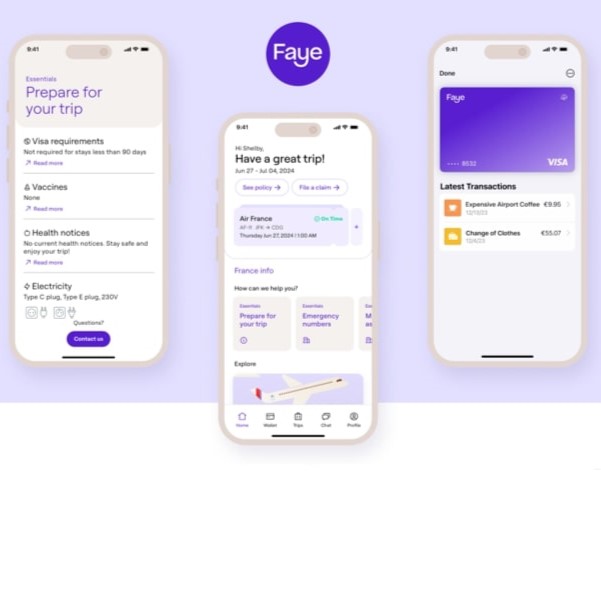

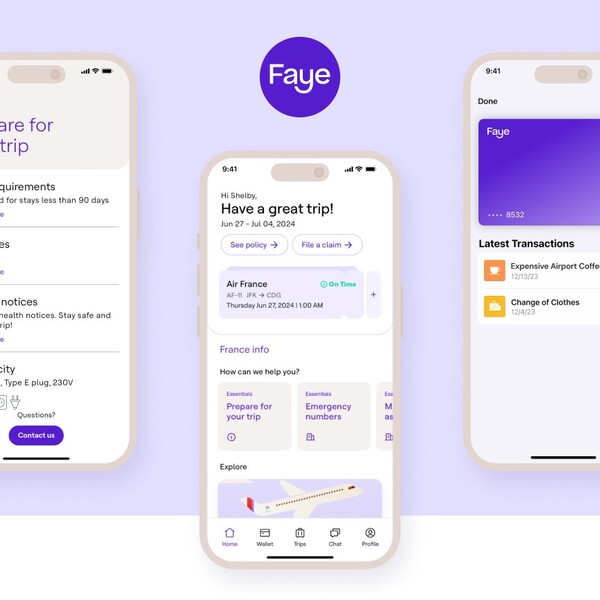

Mobile App Experience

The Faye app functions as your travel companion, not just an insurance portal. Users can purchase coverage in as little as 60 seconds, monitor trip details, submit claims with photo documentation, and access 24/7 support all from one interface. The app’s UI presents policy details in plain language rather than insurance jargon. Flight information updates in real-time with details traditional travel insurance doesn’t provide, such as which terminal to head to, gate assignments, and even which baggage carousel will have your luggage upon arrival.

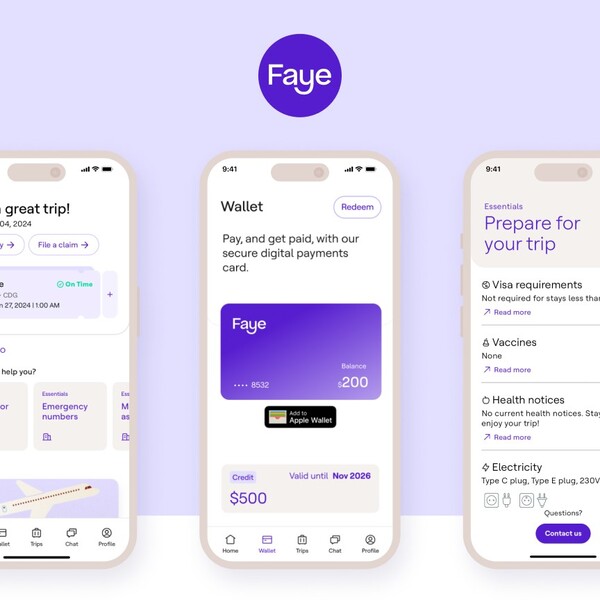

Faye Wallet

The digital reimbursement system addresses a major pain point in travel insurance—waiting for compensation when funds are needed immediately. When claims are approved, money appears quickly in the Faye Wallet rather than waiting days for checks or bank transfers. The wallet integrates with Apple Pay and Google Pay, allowing immediate purchases at millions of merchants worldwide. Users can also transfer funds directly to their bank account if preferred.

Real-Time Travel Alerts

Faye’s monitoring system tracks flights and travel conditions, sending notifications before problems escalate. The system detects delays, cancellations, and weather issues that might affect travel plans. According to customer testimonials, these alerts sometimes arrive before the airlines’ own notifications. The app also suggests alternative flights when connections are missed.

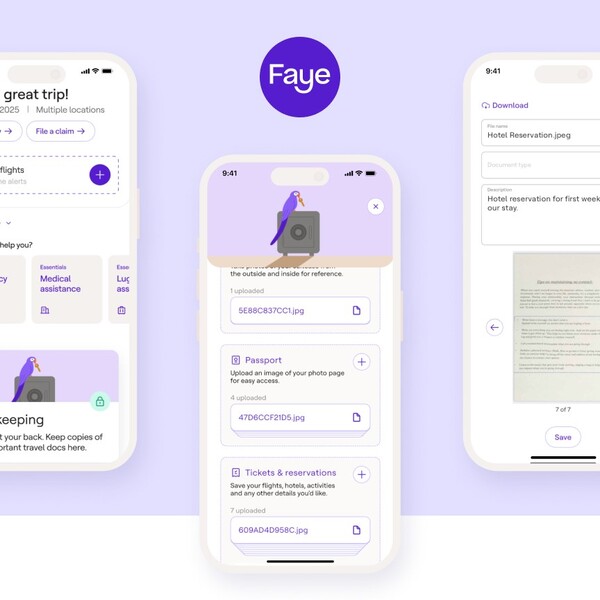

Safekeeping Feature

This secure document storage system uses encryption to protect digital copies of passports, IDs, and itineraries. If your phone is lost or stolen, Faye’s support team can retrieve these documents on your behalf. The feature also stores boarding passes and hotel confirmations for easy access throughout your journey.

eSIM Data Plans

International travelers face connectivity challenges that Faye addresses through direct eSIM provisioning. Rather than searching for local SIM cards or accepting expensive roaming charges, users can purchase and activate data plans directly through the app. This feature is currently available for iOS users with iphone supporting one tap install users traveling internationally, with competitive pricing compared to standalone travel eSIM providers.

Pre-Trip Information

Faye’s destination guides go beyond basic travel advice. The app provides location-specific details like electrical outlet types, and local emergency services. Users receive weather forecasts for their entire trip period and recommendations for local apps that might be useful at their destination.

Digital-first Claims

The digital claims system accepts photo evidence and electronic receipts rather than requiring physical documentation. Claims can be initiated while still traveling, with status updates provided through the app. No printing, faxing, or mailing is involved in the process, and claim status is trackable in real-time rather than waiting for email updates.

Trip Inconvenience Coverage

This unique protection addresses minor disruptions that typically fall below the threshold for traditional insurance claims. The $200 per incident coverage (up to $600 total) applies to situations like extended security checkpoint delays, hotel check-in problems, and rental property lockouts—situations that create stress and unexpected expenses but wouldn’t qualify under standard policies.

Benefits

Travel protection needs to deliver real assistance when problems arise. Faye’s coverage provides several advantages for travelers seeking reliable support during their journeys. Here’s how Faye helps people when travel plans don’t go as expected:

- Comprehensive Emergency Medical Protection. International travelers can receive up to $250,000 in primary medical coverage, meaning there’s no need to file with personal insurance first. This includes hospital stays, doctor visits, medications, and emergency treatments. For domestic travelers, the $50,000 coverage handles unexpected medical issues away from home. International plans include access to a network of 20,000+ telemedicine doctors available in 21 languages.

- Robust Trip Cancellation Coverage. Faye can reimburse up to 100% of prepaid, non-refundable trip costs when cancellations occur for covered reasons. The policy covers a wide range of situations from personal illness and family emergencies to travel provider bankruptcies and natural disasters. With the Cancel For Any Reason add-on, travelers can recover 75% of costs even for reasons not listed in the standard policy, as long as they purchase this add-on within 14 days of their initial trip deposit and cancel their trip by 48 hours prior to departure.

- Family-Friendly Pricing. Adults traveling with children under 18 can access more affordable rates in many states. This makes protecting the entire family’s vacation more economical, especially for longer trips or international travel where emergency medical coverage is essential.

- Quick Resolution of Baggage Issues. When airlines lose or damage luggage, Faye can provide up to $2,000 in coverage (up to $150 per item). For delayed baggage, travelers receive $200 after 6 hours and up to $300 after 12 hours—allowing immediate purchase of necessities without waiting for airline reimbursement.

- Protection for Extreme Sports & Adventure Activities. The optional extreme sports coverage extends emergency medical protection to activities often excluded by standard policies. Travelers participating in activities like skydiving and bungee jumping can add this coverage for peace of mind during adrenaline-seeking experiences.

- Pet Travel Protection. The pet care add-on can cover up to $2,500 in veterinary expenses for pets who become ill or injured during travel. It also can provide up to $250 for additional kenneling costs if return travel is delayed. This allows pet owners to travel with their animals without worrying about expensive emergency vet bills in unfamiliar locations.

- Extended Trip Interruption Coverage. If travelers must cut trips short or extend stays due to covered reasons, Faye can cover up to 150% of the original trip cost. The extra 50% covers additional expenses like last-minute flights home or extended accommodations—costs that often exceed the original trip value.

- Financial Security. Faye’s coverage is underwritten by United States Fire Insurance Company, which holds an A-rating from A.M. Best and has over 200 years of industry experience.

Price

Faye’s pricing varies based on several key factors. Policy costs depend on your destination(s), trip length, traveler ages, state of residence, and selected coverage options.

For domestic trips within the United States, prices start around $4.64 per day for a 14-day trip, while international coverage begins at approximately $5.16 per day for a 14-day tripThese starting rates apply to their whole-trip base plans; adding optional protection like Cancel For Any Reason, adventure sports coverage, or pet care will increase the premium.

Getting a Quote

Getting a quote from Faye is straightforward. When you click the “Check Pricing” button on their website, you’ll meet Tess, their virtual assistant who guides you through the quote process. First, you’ll enter your destination (or multiple destinations one at a time if traveling to several countries). Next, you’ll specify your travel dates by selecting when your trip begins and ends. Faye then asks where you live, as your state of residence affects both pricing and available coverage options.

Finally, you’ll provide the names, birthdays, and email addresses for everyone traveling, with an option to add multiple travelers to the same policy. This information allows Faye to calculate an accurate quote based on your specific trip details.

Sample Policy

As a real-world example, a 24-day trip to the United Kingdom for one traveler from California with $3,000 in trip cost protection would cost $191 total ($7.96 per day). This policy includes:

- $250,000 for emergency medical expenses (primary coverage)

- $500,000 for emergency medical evacuation

- $3,000 for trip cancellation (100% of your total estimated trip cost)

- $4,500 for trip interruption (150% of your total estimated trip cost)

- $300 per day for trip delays (maximum $2,100)

- $100,000 for non-medical emergency evacuation

- $2,000 for lost/damaged baggage ($150 per item maximum)

- $300 for baggage delay

- $200 for missed connections

- Pre-existing medical condition coverage (if purchased within 14 days of initial trip deposit and medically able to travel upon purchase)

Adults traveling with children under 18 can access reduced rates in many states. Faye also allows buyers to adjust trip costs after purchase (within certain timeframes) if travel plans change.

For maximum value, purchasing a policy within 14 days of making your first trip deposit unlocks additional benefits, including pre-existing medical condition coverage and eligibility for the Cancel For Any Reason add-on.

Faye Review: What Do Customers Think?

Customers consistently praise Faye’s responsive support team, with many highlighting how real humans provided immediate assistance during travel disruptions. The 24/7 availability of personalized help stands out as a major advantage in user reviews.

“During a trip to Greece, I dislocated my knee and was fearful that my trip would need to end. Upon contacting Faye, I was given incredible support from the get-go.”

Fast claims processing appears to be Faye’s most appreciated feature. Travelers report receiving reimbursements in remarkably short timeframes, sometimes within minutes rather than the weeks typically associated with insurance claims.

“Baggage was delayed significantly on a 2-week vacation leaving us stranded without our things. Faye reimbursed us for the inconvenience within 30 minutes of reaching out about our issue.”

The Faye app earns high marks for its intuitive design and helpful features. Users particularly value the real-time flight information, which some say updates faster than airline notifications, and the streamlined claims submission process.

“Once I downloaded the app, everything was super easy. The flight information was more current than the airline! Impressive.”

Many customers mention feeling more secure during their travels knowing Faye was available if problems arose. Professional travel advisors also endorse Faye’s services, noting that their clients receive exceptional care and attention.

“It was like having you along with us on our entire trip. Gives one a great deal of confidence.”

Is Faye Travel Insurance Legit?

Yes, Faye travel insurance is absolutely legitimate. The company launched in 2022, and their policies are underwritten by United States Fire Insurance Company, which holds an A-rating from A.M. Best and has been in business for over 200 years. Their financial backing ensures that claims will be paid properly. Faye operates as a licensed insurance provider with proper state authorizations and transparent policy documentation.

Is Faye Travel Insurance Worth It?

Faye travel insurance delivers exceptional value for travelers who want digital convenience without sacrificing coverage quality. Their policies include all the essential protections of traditional travel insurance—emergency medical coverage, trip cancellation, baggage protection—while adding modern features that enhance the travel experience. The combination of comprehensive coverage with user-friendly technology creates a package worth considering for any trip.

The pricing structure remains competitive with other travel insurance options while offering superior digital tools. At roughly $5-8 per day for most trips that are two weeks, Faye provides peace of mind without significantly increasing vacation costs. The ability to receive near-instant reimbursements on eligible claims through the Faye Wallet alone justifies the premium for many travelers, as it solves the common problem of being stuck without funds when travel issues occur.

For frequent travelers, the value becomes even more apparent. The app’s flight tracking, document storage, and real-time alerts function as practical travel tools beyond just insurance protection. When comparing the cost against potential expenses from medical emergencies abroad or last-minute trip cancellations, Faye’s coverage proves to be a smart investment that makes the entire travel experience smoother. The 24/7 support and rapid claims processing further validate the reasonable premium, making Faye a worthwhile choice for protecting your next journey.

Faye Discounts and Promotions

Faye offers several benefits for travelers on their travel protection plans:

- Attractive Family Rates. Pocket-friendly rates for adults traveling with children under 18

- State Availability. Family rates currently available in 20 states including Texas, Arizona, Colorado, Georgia, and Wisconsin

- Seasonal Promotions. Limited-time offers for brands they partner with occasionally appear through email newsletters

- Transparent Pricing. Rather than relying on coupon codes, Faye focuses on clear pricing that avoids unnecessary coverage

Where Can I Buy Faye Travel Insurance?

Faye travel insurance is available through multiple convenient purchase channels:

- Faye Website. Visit withfaye.com and click “Check Pricing” to begin the quote process with their virtual assistant Tess

- Mobile App. Download the Faye app from the Apple App Store or Google Play Store to purchase policies directly from your phone

- Travel Advisors. Many professional travel agents and advisors can offer Faye policies as part of their service packages

The purchase process typically takes as little as 60 seconds once you’ve entered your basic trip information. You’ll receive immediate confirmation via email with full policy details, and your coverage will be accessible through the Faye app if you choose to download it.

How Do I Contact Faye?

Faye offers multiple ways to reach their customer service team:

- 24/7 In-App Support. The fastest way to connect with Faye is through their mobile app’s chat feature, available on both iOS and Android devices

- Email Support. General questions: [email protected] Claims assistance: [email protected] Feedback: [email protected]

- Phone Support. US callers (toll-free): +1-833-240-7056 International callers: +1-804-482-2122

- Business Hours. Customer experience specialists are available 24 hours a day, 365 days a year, including weekends and holidays

- Emergency Assistance. For medical emergencies during travel, call their phone numbers directly rather than using email

- Technical Support. App or website issues can be reported via email to [email protected]

- Claims support. For support on claims, chat with the team in-app or email [email protected]

Human customer service representatives are available 24/7 to answer questions and provide support.

Next, explore some similar reviews we’ve published:

Ask the community or leave a comment

WRITE A REVIEWCustomer Reviews

Leave a review